Broadcom (NASDAQ: AVGO) has officially joined the $1 trillion club ranks, a milestone it achieved following an exceptional fourth-quarter earnings report on December 12. The company, known for its advanced semiconductor and software products, stands alongside Nvidia (NASDAQ: NVDA) and other tech giants benefiting from the booming artificial intelligence (AI) industry. Let’s take a closer look at how Broadcom reached this remarkable milestone and what it means for the future of AI technology.

Broadcom’s Role in the AI Revolution

Over the last few years, artificial intelligence has become a technological driving force, reshaping industries and fueling demand for cutting-edge computing hardware. Nvidia, long considered the leader in AI chips thanks to its powerful GPUs, has been the poster child of this transformation. However, Broadcom has quietly been carving out its niche in the AI semiconductor market, emerging as a key player with specialized products that complement Nvidia’s offerings.

Broadcom’s success in the AI sector stems from two critical areas: networking chips and custom AI accelerators. The company’s networking chips, such as the Tomahawk and Jericho switches, are essential for AI data centers. These chips ensure efficient data movement across servers, maximizing the processing power of GPUs like those from Nvidia. This seamless data flow reduces downtime and redundancy, critical factors for companies investing billions in AI infrastructure.

The other cornerstone of Broadcom’s AI business is its custom AI accelerators. These chips are tailored to the specific needs of major tech players like Alphabet, Meta Platforms, and ByteDance, the parent company of TikTok. Broadcom has positioned itself as a trusted partner in developing next-generation AI technologies by working closely with these companies.

Big Deals That Shaped Broadcom’s Future

Broadcom’s journey to the $1 trillion mark has been challenging. 2018, the company made headlines when it attempted to acquire Qualcomm for $120 billion. The deal, which would have been the largest in tech history, was blocked by the Trump administration over national security concerns. Broadcom was headquartered in Singapore at the time, which added to the scrutiny. Broadcom’s CEO, Hock Tan, continued making bold moves despite the setback.

Since then, Broadcom has completed several major acquisitions that have diversified its business beyond semiconductors. These include:

- CA Technologies (2018): A $19 billion acquisition that brought Broadcom into the enterprise software market.

- Symantec’s Enterprise Security Business (2019): A $10.7 billion deal that expanded Broadcom’s presence in cybersecurity.

- VMware (2022): A massive $61 billion acquisition that solidified Broadcom’s position in infrastructure software.

These strategic acquisitions have transformed Broadcom into a well-rounded tech powerhouse with a balanced mix of semiconductor and software offerings.

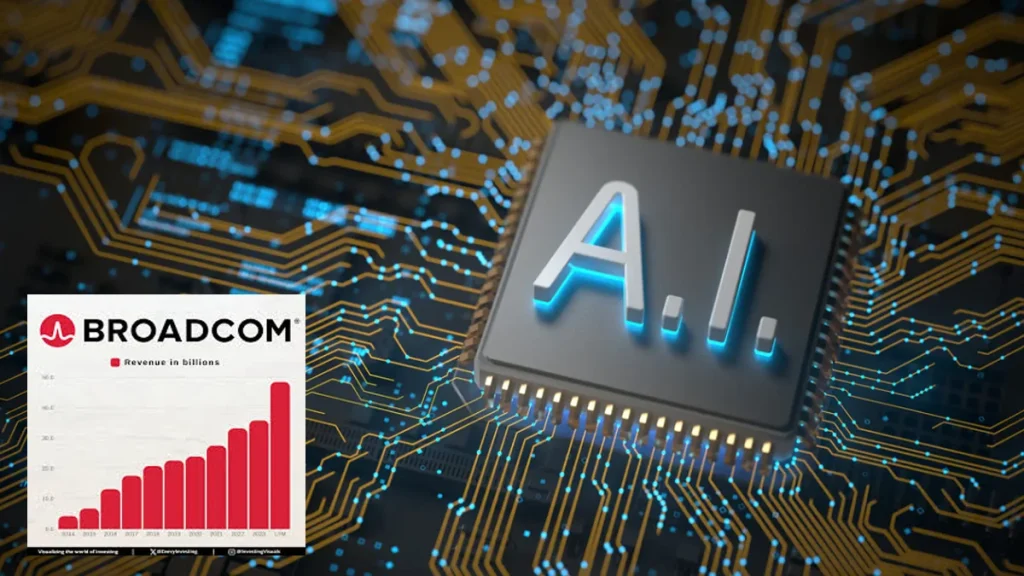

AI Revenue Drives Exponential Growth

Broadcom’s latest earnings report underscores the impact of AI on its business. In the fiscal fourth quarter, the company’s AI-related revenue surged 150% year-over-year to $3.7 billion. This growth was fueled by strong demand for its networking chips and AI accelerators, crucial for running large-scale AI models.

Overall, Broadcom’s revenue for the quarter rose by 51% to $14.05 billion, driven by both its semiconductor and software divisions. The company’s infrastructure software segment generated $5.82 billion in revenue, nearly tripling from the previous year thanks to the VMware acquisition.

Broadcom’s management expects AI revenue to grow at an impressive rate. The company has projected a 65% year-over-year increase in AI revenue for the current quarter, reaching $3.8 billion. This growth is part of a broader trend as tech giants like Alphabet, Amazon, Meta, and Microsoft invest heavily in AI infrastructure.

Broadcom’s Competitive Edge in AI

While Nvidia remains the undisputed leader in AI hardware, Broadcom has carved out a unique position in the market. The company’s custom AI accelerators, XPUs, are designed for hyperscale customers like Google, Meta, and ByteDance. These chips offer significant performance and efficiency benefits, enabling faster processing and lower power consumption.

Broadcom’s focus on custom solutions sets it apart from competitors. Unlike Nvidia’s widely available GPUs, Broadcom’s XPUs are tailored to the specific needs of its customers. This bespoke approach has helped Broadcom secure long-term relationships with the world’s largest tech companies.

The Road Ahead: Risks and Opportunities

Despite its recent success, Broadcom faces several challenges. The company’s premium valuation—currently trading at about 36 times forward earnings—reflects high investor expectations. Any slowdown in AI spending or technological advancements could impact Broadcom’s growth trajectory.

Moreover, Broadcom operates in a highly competitive industry. While it has established a strong foothold in the AI market, rivals like Nvidia, Intel, and AMD constantly innovate. Broadcom will need to continue investing in research and development and securing new customer partnerships to maintain its edge.

On the flip side, Broadcom’s addressable market in AI semiconductors is enormous. Management estimates that its top three hyperscale customers alone represent a market opportunity of $60 billion to $90 billion by 2027. New customers, including Apple and OpenAI, could further expand this market.

Broadcom’s diversification into software also provides a cushion against potential downturns in the semiconductor market. With VMware now a key part of its business, Broadcom has a more stable revenue stream to complement its high-growth AI segment.

Why Investors Are Bullish on Broadcom

Investors have plenty of reasons to be optimistic about Broadcom’s future. The company’s strong earnings growth, driven by its AI and software businesses, has positioned it as a leader in the tech industry. Analysts expect Broadcom’s earnings to grow by 28% in 2025 and 20% in 2026, supported by robust product demand.

Additionally, Broadcom’s ability to deliver custom solutions for hyperscale customers gives it a competitive edge. These chips are highly advanced and indispensable for running the next generation of AI applications. As AI technology continues to evolve, Broadcom is well-positioned to capture a significant market share.

Broadcom’s entry into the $1 trillion club is a testament to its strategic vision and ability to adapt to changing market dynamics. The company has become a key player in the tech industry by focusing on AI and diversifying its business.

Broadcom represents a compelling opportunity for investors to gain exposure to the growing AI market. While risks are associated with its premium valuation, the company’s strong fundamentals and growth prospects make it an attractive option for long-term investment.

As Broadcom continues to innovate and expand its AI capabilities, it’s clear that the company’s best days are still ahead. Whether you’re a seasoned investor or just starting, Broadcom’s journey to the $1 trillion club offers valuable insights into the power of strategic planning and execution in the fast-paced world of technology.

TechWise.com is your reliable source for the latest tech news, reviews, and simple guides. We’re here to make technology easy to understand for everyone. Whether you’re a big fan of tech or just use it in your daily life, we offer helpful articles, expert advice, and practical tips to keep you updated in the fast-changing world of technology. Stay with us for the newest updates on gadgets and trends in the tech world.